Open order 15.15 close order 17.20 server time alpari.uk

GBUSD : +101

USDCHF : +44

USDJPY : +41

Total : 186 pips

EURUSD : N/A

GBUSD : Bearish entry 1.4549 tp1 1.4514 tp2 1.4422 sl 1.4322

USDCHF : Bullish entry 1.1534 tp1 1.1552 tp2 1.1620 sl 1.1487

USDJPY : Bearish entry 91.13 tp1 90.62 sl 91.39

Read More....

USD / JPY Still Calm at 91.2

USD / JPY is still in the range of 91.2 to this night. Pair moved relatively narrow ranging throughout the day. Option expiry on the level of interest in selling at 91.0 and 91.5 still continues to be resistance. If 91.5 impregnable, then 92.0 would be the next target. Another option expiry levels were found in 93.0 and 88.0.

Need pound weakened, EUR / GBP Sharp Rise

EUR / GBP 0.851 sped up to around noon today. Action substantial purchasing related needs of the end of the month to make Euro tersupport. In addition, British officials claim that Pound should be weakened to stabilize the depressed economy is making GBP. If the EUR / GBP was not able to continue the momentum, then the target will be 0.84 and 0.833 re-targeted.

Stronger Post-CHF Swiss Export Data Satisfactory

USD / CHF move down to around 1.152 this afternoon, along with the strengthening of CHF. This reinforcement was triggered by rising export reports in Switzerland. Option expiry at 1.15 level and if it penetrated the cells stop reportedly was in the range of 1.149 to 1.148. While for the EUR / CHF, there are reportedly selling interests in 1.428 and resistance will be strong enough before the pair could touch 1.43.

GBP / USD 1.459 at the beginning Tap European Session

GBP / USD rose to 1.459 in early Asian session today, and now slightly turned down to 1.457. If the pair climbed through 1.461, the buy stop was waiting with a target sell limit at 1.464. Buy stop further rumored around 1.465. GBP also middle East tersupport by purchasing plans by Royal Dutch Shell Resource, as well as AIA's acquisition by Prudential.

Eropa Session

———————————————–

13:40 WIB — Amerika — Pidato Bullard — Presiden Fed St. Louis, James Bullard, akan membawakan pidato berjudul “Policy Challenges for Central Banks in the aftermath of the Crisis” di Konferensi SwedBank “Economic Policy in Aftermath of the Crisis”, bertempat di kota Stockholm.

17:00 WIB — Inggris — CBI Realized Sales — Survey terhadap ritel dan grosir di Inggris menunjukkan angka sama sebesar 13 dalam 2 bulan terakhir, dan data hari ini diperkirakan juga akan sama di kisaran 13.

Amerika Session

———————————————–

19:30 WIB — Amerika — Preliminary GDP — Data GDP Inggris akan dinantikan, setelah melesat tajam 5,9% bulan lalu, data hari ini diprediksi akan terkoreksi, namun masih positif. Jika dirilis di atas 3,5% maka akan baik bagi GBP, karena data ini menggambarkan prediksi kesehatan ekonomi Inggris.

19:30 WIB — Amerika — Unemployment Claims — Klaim pengangguran minggu lalu secara mengejutkan naik menjadi 471.000 padahal diprediksikan turun sebelumnya. Data hari ini diprediksi akan turun menjadi 450.000. Jika dirilis lebih tinggi, bahkan lebih dari bulan lalu, akan membebani USD.

According to the Office for National Statistics (ONS), the British economy during the first three months of the year 2010 has been growing much faster than those estimates, around 0.2%. UK economic growth rate reached 0.3% between January to March 2010 this. Industrial production and business services play a major role in economic growth earlier this year.

Although the numbers achieved quite good English but still lower than that achieved in 2009 which reached 0.4%. Industrial output growth was also revised to 1.2% from the previous prediction that only reached 0.7%. The manufacturing sector also grew about 1.2%. While the level of private consumption tend not to describe the increase so it can be said the British economy is still far from balanced.

Read More....

Organisation for Economic Co-operation and Development (OECD) has warned the euro zone to be more attention to their economic recovery and also the Euro exchange rate, since the debt crisis that hit Europe could threaten the economic recovery of the region. According to predictions, the European economy will register 1.2% growth this year. While the OECD forecasts growth in Europe will only reach 0.9%.

According to Germany, the disbursement of funds amounting to hundreds of billions of Euros to the bailout crisis, the Greek is a difficult step for all members if it is not able to manage finances effectively. While according to the OECD, will be more effective if carried out for closer scrutiny of each country and provide financial sanctions for countries that do not pay their loans on time. OECD members are predicted to experience economic growth of 2.7% this year and 2.8% in 2011. Economic growth is predicted to reach 1.2% this year and 2.5% next year is still far better than other developed economies, except China and India. The OECD also suggested the Bank of England to raise interest rates to 3.5% in the previous year end 2011 from just 0.5%.

Read More....

Open order 05.00 close order 11.00 server time alpari.uk

EURUSD : +72

GBUSD : +50

USDCHF : +74

USDJPY : +31

Total pips today : 227

As part of our gratitude for the trust given by the member, then Indonesia will hold a contest Prime4x special trading members each month with a total prize of USD 2000

Period I: June 1, 2010 until July 2, 2010

Period II: July 5, 2010 until July 30, 2010

Third Period: August 2, 2010 until 3 September 2010

Contest Rules:

1. Terms and conditions of the contest:

* For new clients as well as a long-

* A name (ID) may only have one account contes

2. Contest Period:

* Starting from Monday the first week of every month

* Ends on Friday last week of every month

3. Contests trading account:

* The minimum equity of $ 300 at the beginning of the period

* All accounts with equity of at least $ 300 beginning of the contest period are automatically entered in the contest.

* Withdrawal is done when the period of the contest does not create these accounts in disqualification

* Margin call when the contest period does not create these accounts be disqualified.

* No need to open a position to determine the winner in close

* Deposit is done when the contest period will be counted as additional initial equity ... detail click this link

EURUSD : Bullish entry 1.2228 tp1 1.2303 sl 1.2165

GBUSD : Bullish entry 1.4382 tp1 1.4410 tp2 1.4435 sl 1.4322

USDCHF : Bearish entry 1.1586 tp1 1.1477 sl 1.1629

USDJPY : Bullish entry 90.01 tp1 90.76 sl 89.55

EURUSD : Bullish entry 1.2293 tp1 1.2446 sl 1.2236

GBUSD : Bullish entry 1.4384 tp1 1.4501 sl 1.4311

USDCHF : Bearish entry 1.1610 tp1 1.1477 sl 1.1658

USDJPY : Bullish entry 90.14 tp1 90.76 sl 89.73

Read More....

Had rebounded overnight, the EUR / USD back down below 1.23. Pairs are now in the 1.228 level. The next support level at 1.226. Bernanke's statement that the Fed will continue to provide supply to the planned exchange of CAD makes Euro depressed. Several banks in Europe reportedly USD liquidity difficulties at this time.

Read More....

USD / JPY was at the level of 90.1 this morning. Buying interest still exists in the range of 90.0 and a support for the USD / JPY. When pierced, the 88.9 predicted to be targeted next. Interest will be selling at 90.5 for the current resistance.

Read More....

EURUSD : Bullish entry 1.2191 tp1 1.2262 sl 1.2152

GBPUSD : Bullish entry 1.4296 tp1 1.4327 tp2 1.4410 sl 1.4251

USDCHF : Bearish entry 1.1692 tp1 1.1635 tp2 1.1574 sl 1.1696

USDJPY : Bullish entry 89.49 tp1 89.80 tp2 90.20 sl 89.33

Read More....

European Session

——————————————————

13:00 pm - Switzerland - UBS consumption indicator - This data is a combination of several other indicators, including consumer spending, consumer confidence, tourism, automotive, and retail. If better than the data released last month amounted to CHF 1.71 will be profitable.

15:30 pm - English - Revised GDP - GDP figure is very important because it will provide the benchmark of economic activity in the UK today. Predicted figures were the same as before, namely equal to 0.3%. If the release is better, it will provide support for the GBP.

16:00 pm - Europe - Industrial New Orders - The number of orders on manufacturing-manufacturing in Europe rose 1.5% last month. This month, an increase of 2.2% is predicted to be listed, if released in the 2.2% it will be good for the Euros.

American session

——————————————————

21:00 pm - America - CB Consumer Confidence - The data has increased significantly last month and this showed increased optimism of American society to the current economic conditions. Today's data is also predicted to rise again to 59.1. If released in the above figures, it will benefit the U.S. dollar.

22:15 pm - America - Speech Bullard - President of the Fed St. Louis, James Bullard, will bring a speech titled "The Road to Economic Recovery Following the Financial Crisis" at the European Economics and Financial Center, London.

International Monetary Fund (IMF) began to focus on the Spanish economy now appears to need a great effort to restore its economy. According to the IMF, now Spain is facing some tough challenges like reforming dysfunctional labor markets and the banking sector. The IMF comments came after hearing the Spanish authorities who want to help creditors Cajasur at the end of pecans yesterday. Parties

The administration must borrow money to pay for public services because of taxes and other revenues are not sufficient. It shows the economic decline of Spain. This is not the first comment from the IMF, the IMF had also previously warned Spain to reform its economy, such as the payment of employee wages.

Last week, the Spanish government has planned to set up funds of 15 billion Euros to pay the wages of workers and reduce the deficit Tertiary. In addition, Spain also had to overcome the problem of unemployment which has reached more than 20%. Amid concerns Greece and also failed to pay the Spanish crisis, 27 members of the European Union and the IMF again provided funding amounting to 750 billion Euros to overcome this crisis. 440 billion loan funds are sourced from each country, 60 billion from the European Commission funds and another 250 billion from the IMF.

Read More....

Last week, the Spanish government has planned to set up funds of 15 billion Euros to pay the wages of workers and reduce the deficit Tertiary. In addition, Spain also had to overcome the problem of unemployment which has reached more than 20%. Amid concerns Greece and also failed to pay the Spanish crisis, 27 members of the European Union and the IMF again provided funding amounting to 750 billion Euros to overcome this crisis. 440 billion loan funds are sourced from each country, 60 billion from the European Commission funds and another 250 billion from the IMF.

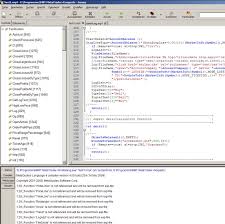

In MetaTrader 4, there is a function called "Expert Advisor" Commonly abbreviated EA, Or as we used too familiar with the term robot. This function is useful to order the computer to automatically analyze the charts and then make trades based on the results of the analysis. Of course, so that the computer can do this automatically, we need to provide rule or the rules, so that the computer can translate the desires and our trading strategy.

To facilitate understanding, we provide the following illustration:

Basic steps to create a robot that is able to generate profit is as follows:

Read More....

* You are trading the EUR / USD with H1 timeframe.

* You want to open a buy, any price increase through the highest point in the last five hours.

* You want to open a sell, any price falls through the lowest point in five hours

* With these clear rules, you can translate it in a programming code, and make yourself via MQL

Editor EA is already supplied at the time to install MetaTrader 4.

* After the EA so, simply pairing on H1 timeframe, then the computer will open a 'buy and sell their own position, without you need to click any buttons. Thus of course it is easier for traders, because it will not miss any moment of analysis and, well do not need to sit at the computer for hours waiting for the signal to open positions.

Basic steps to create a robot that is able to generate profit is as follows:

- Think about your trading rules and strategies, to translate into a complete and clear pattern. Example: Open a buy if the pair move higher over the five successive bars, then close the position if the last bar is the highest point below the highest point of the previous bar.

- Pour the detailed steps on no one was into the programming language MQL. If the trouble, you can read a detailed guide on Help or MQL Editor consult with SFX Club.

- After EA in-compile, Do backtest several times and find a favorable setting. Perform forward test with the best settings for 1-2 weeks.

- If you continue to profit, before running the EA on real account and reap the profits, even while you sleep at night.

Economic data released by the schedules are almost the same every day, here are the schedules by country: Australia - AUD - 5:30 pm until 7:30 pm Japanese - Yen - 6:30 pm until 11:30 pm Switzerland - CHF - 13:30 am until 17:30 pm Germany, Italy, France (Europe)

Economic data released by the schedules are almost the same every day, here are the schedules by country:

* Australia - AUD - 5:30 pm until 7:30 pm

* Japan - Yen - 6:30 pm until 11:30 pm

* Switzerland - CHF - 13:30 am until 17:30 pm

* Germany, Italy, France (Europe) - Euro - 14:00 am until 18:00 pm

* English - GBP - 14:00 am until 18:00 pm

* Canada - CAD - 19:00 am until 20:30 pm

* America - CAD - 19:30 am until 22:00 pm

The news release did not all have an impact on price movements, we will try to summarize some news that normally cause extreme movement in the release:

1. NFP (Non Farm Payroll)

Data indicate the total number of salaries reported by U.S. Buearu of Labor Statistics, excluding civil servants and workers in agriculture. This data is expected to give you a salary rate of 80% of workers in America. Non Farm Payroll is important because it shows the rise and fall is also forecast the unemployment rate and GDP, while also going to be considered for determining the economic policies in times to come.

2. Interest Rate / Bank Rate

Increase in interest rates will generally lead to good effect for the relevant country's currency, due to rising interest rates, investors are expected to be signed in to invest and means higher demand for currency.

3. GDP (Gross Domestic Product)

GDP is the value of all goods and services produced by a country within a certain timeframe, usually annual, or per year. This data is very important because it will measure all aspects of the state, including government spending, and Expo on foreign imports, as well as public consumption. GDP to be the main indicator to measure the economic health of countries, including the standard of living of its citizens. GDP is a negative value would indicate an economic slowdown and even recession perrtanda.

4. Retail Sales

This data shows the number of items sold at the retail level. This figure is very important because it will show the economic activities of society, the numbers continue to rise shows a vibrant economy, otherwise the numbers continue to fall will show a sluggish economy. This data will also be the basis of interest rate policy-making, tax, and others.

5. Home Sales

Sales of homes, both new and used homes, will show the level of activity in the community. Purchase high house give their view that people's purchasing power is still high. This data will also be influential on other data, such as new building permits, home loans, pawnshops, and others.

6. CPI (Consumer Price Index)

This data mengukut price change of goods and services consumed by society, including transportation costs, food prices, and health care costs. CPI figures are often used to identify the occurrence of inflation or deflation. Sharp increase in the number of consecutive time will show the existence of inflation, and instead showed a sharp decline in deflation.

7. PPI (Producer Price Index)

PPI data shows price changes of goods and services from the manufacturer. This index will provide the economic outlook such as the CPI, but in terms of producers and sellers.

8. PMI (Purchasing Managers' Index)

Figures released will act as a leading indicator of manufacturing sector. This data will include the number of orders, supply, production levels, stock, and also employment. Figures below 50 would indicate kontaksi, and the figure above 50 indicates an increase in the manufacturing sector.

9. Trade Balance

Difference between exports and imports of a country is also one important indicator of economic health. Large deficit will affect the state budget.

10. Inflation

Report of rising inflation would be bad for the economy of a country, and currency impact on the strength of the country concerned. The central bank usually will take immediate steps to halt rising inflation, the ideal level is usually targeted by central banks is around 2% up to 3%.

But there are also some news that was released outside the hours mentioned above, but its frequency is very low. The speeches by officials, economic officials also sometimes performed outside these hours. Economic officials from the Fed, ECB, BoE, and various other central banks, typically hold a press conference to clarify its policies, as well as giving his views on economic conditions, in addition, they sometimes follow the conferences in other countries or attending a panel discussion, their pronouncements often creates optimism and pessimism among investors and the impact on currency movements.

EU Finance Ministers will meet in Brussels to discuss the issue in order not to worsen the crisis such as Greece. During the meeting there will likely discuss the EU budget rules to tighten financial regulation. However, the exact agenda is to discuss the national budget proposals, the recommended set during the first six months, replacing the current budget setting is done in the second half. But apparently the idea will cause controversy, especially with England.

Besides, in this meeting of EU ministers will also talk about sanctions that will be given to the State which does not comply with the stability and growth of the agreement previously agreed. This will force a country to deposit some money in the bank tocover country's debt if someday they have trouble paying its debts. The meeting will be held under the leadership of President Herman Van Rompuy the European Union.

AIG Construction IndexLevel composite index based on the construction company. above 50 indicates expansion of the industry, by contrast shows contraction AIG Indexlevel Manufacturing of composite index based on manufacturing-manufacturing surveyed. Above 50 indicates expansion ...

| AIG Construction Index | Level composite index based on the construction company. above 50 indicates expansion of the industry, by contrast shows contraction |

| AIG Manufacturing Index | level of the combined index, based on manufacturing-manufacturing surveyed. Above 50 indicates expansion in manufacturing, on the contrary indicates contraction |

| AIG Services Index | Level composite index based on surveyed firms ministry. Above 50 indicates expansion, on the contrary indicates contraction. |

| Annual Budget Release | This document underlines the government funds during the first year, including expenditure and revenue, loans, financial objective and the planned investment. Use and loans can be significant pressure for the economy. |

| Annual Budget Release | Released per year. Domestic government spending and borrowing can have an important influence on the economy. |

| ANZ Commodity Prices | Changes in the global prices of commodity exports. . |

| ANZ Job Advertisements | Changes in the number of jobs advertised in major newspapers and websites daily in the capital. Have a major impact when released to the government labor data. |

| Asset Purchase Facility | Total value of money that BOE will create and use them in acquiring assets in the market. This triggers the bill is likely to reduce long-term interest rates. |

| Average Earnings Index | Changes in the price and payment of business by government workers, including bonuses. This is an indicator of consumer inflation when businesses pay more to workers, it will affect consumers. |

| Average Hourly Earnings | Changes in workers' wages, unless the agricultural industry. This is an indicator of consumer inflation. The higher the salaries of workers, the greater the price set for consumers. |

| BOE Inflation Report | This report contains the views are important according to the BOE will be the economic conditions and inflation - the key factors that shape the future of monetary policy and interest rates affect the decision. |

| BRC Retail Sales Monitor | Change the value of retail sales in the same store. |

| BRC Shop Price Index | Price changes of goods bought in stores BRC. |

| Building Approvals | Changes in the number of new buildings approved. This added julmah labor involved in development. |

| Building Permits | Changes in the number of buildings allowed. This shows the construction of a future where getting a permit is the first step in the construction of new buildings. |

| Business Inventories | Changes in the total value of goods in inventory by the manufacturing, wholesale and retail. This is a signal future business because the company will buy the goods when their inventory is not sufficient. |

| Business NZ Manufacturing Index | Level composite index based on manufacturing surveys. The survey on assessing the level of manufacturing business conditions such as labor, production, new orders, prices, delivery by suppliers and inventory. |

| Cash Rate | The interest rate for overnight deposits. Rates are determined in the market. Short-term interest rate is the highest factor in the evaluation currency. |

| CBI Industrial Order Expectations | Level composite index based on surveyed manufacturers. On top of 0 indicates the volume of orders expected to be increased, and vice versa. |

| CB Leading Index | Changes in the level of a composite index based on seven economic indicators. This index is designed to predict the direction of the economy. 7 Indicators that relate to the combined production, new orders, consumer confidence, stock prices and the spread in interest rates. |

| CGPI | Changes in the price of goods sold by the company. This is an indicator of consumer inflation, when prices go up it will burden the consumer. |

| Challenger Job Cuts | Changes in the amount of labor cuts. |

| Claimant Count Chage | Changes in the number of people claiming benefits related to unemployment. While this is generally regarded as an indicator of late but the amount of unemployment is an important signal of overall economic health because consumer spending is very influential in labor market conditions. |

| Commodity Prices | Changes in selling prices of export commodities. This is an indicator of the balance of a country with other countries, it is very important to increase commodity prices, increasing export earnings. |

| Construction PMI | Level composite index based on a survey of purchasing managers in the construction industry. Above 50 indicates expansion, on the contrary indicates contraction. |

| Construction Spending | Changes in the total number of builders used on construction projects. |

| Consumer Credit | Change the value of total consumer credit. This is related to consumer spending and confidence. |

| Core CPI | Changes in prices of goods and services purchased by consumers, except for food, energy, alcohol and tobacco |

| Core Machinery Orders | Changes in the total value of machinery in the new private sector by the manufacturer, except for shipping and utilities. This is an indicator of production. |

| Core PCE Price Index | Changes in the prices of goods and services purchased by consumers, except food and energy. Rates are calculated based on total expenditures per item. This is a favorite measure of inflation from the Federal Reserve. |

| Core Retail Sales | Change the value of total retail sales, except the automobile. Automobile sales approximately 20%, but they tend to be very volatile and disturbing trend. |

| CPI | Changes in prices and services purchased by consumers. Inflation is important for evaluation of the currency due to increased price makes the central bank to raise interest rates. |

| Credit Card Spending | Changes in total spending, facilitated by credit card. This relates to consumer spending and confidence. |

| Crude Oil Inventories | Changes in the amount of crude oil per barrel in the inventory. This will affect the price of petroleum products which affects inflation but influential both for the industry that rely products to crude oil. |

| Current Account | The difference between exports and imports of goods, services, financial flows and unilateral transfers. This is directly related to the demand for currency - rising surplus indicates that foreigners buy more local currency. |

| DCLG HPI | Changes in selling prices of houses. Tend to have a weak effect because there are many indicators that affect housing prices. |

| Economy Watchers Sentiment | Level composite index based on the surveyed workers. Above 50 indicates optimism, pessimism otherwise indicated. |

| Empire State Manufacturing Index | Level composite index based on the manufacturers surveyed in New York. This indicates economic health. |

| Employment Change | Changes in the amount of labor. Job creation is an important indicator in spending money and a major influence on the market. |

| Factory Orders | Change the value of total new orders to manufacturing. This shows the production, purchase orders signals that the rose also increased the work activities to fulfill the order. |

| Federal Budget Balance | Differences in values between the federal government revenue and expenditure. Positive values indicate a surplus of funds, by contrast showed a deficit. |

| Final Manufacturing PMI | level composite index based on surveyed purchasing managers in manufacturing industry. This is an indicator of economic health, in which businesses react quickly terhadapa market conditions. |

| Final Mortgage Approvals | Number of new loans approved for house purchases over the past month. |

| Final Service PMI | Level composite index based on surveyed purchasing managers in service industries. |

| Fixed Asset Investment | Changes in total expenditures on capital investments such as factories, roads, and property. It shows the economic health, changes in the private or public investment can be early signals of future economic activity. |

| Flash GDP | Changes in inflation, which is adjusted by the value of all goods and services. This is the best measure of economic activity with the width and the main measure of economic health. |

| Foreign Direct Investment | Changes in total spending on domestic capital investment by foreign companies. |

| Foreign Direct Investment | Changes in the amount of use of domestic investment by foreign companies. |

| Foreign Securities Purchases | The total value of domestic stocks, bonds and money market assets purchased by foreign parties. Demand on the domestic securities and currencies are interconnected because the foreigners have to buy the domestic currency to buy securities of a country. |

| German Factory Orders | Changes in the total value of new purchase orders. This is an indicator of production, improve purchase order indicates that manufacturing activity will increase. |

| German Retail Sales | Changes in inflation adjusted value of total retail level denan except automobiles and gas pumps. This is the main measure of consumer demand. |

| Home Loans | Changes in the amount of new loans granted to owners of new homes. This is an indicator for the housing market, showing that the presence of certain buyers into the market. |

| Household Confidence | Level composite index based on the surveyed households. |

| Housing Starts | The number of new residential buildings that began construction on a yearly basis. This can cause related effects. Many workers, subcontractors and inspectors and services required. |

| HPI | Changes in selling prices of houses. This is an indicator of industry health of the house because house prices could increase to attract investors and promote the spirit of industrial activity. |

| HSBC Manufacturing PMI | Level composite index based on a survey of purchasing managers of manufacturing industries. In the top 50, will experience expansion, while below 50 will experience a contraction. This is an indication of economic health, the business to react quickly to market conditions, and are a reflection of purchasing managers that are relevant for the company's economic |

| IBD/TIPP Economic Optimism | The level of a composite index based on consumers surveyed. Above 50 indicate optimism, below that indicates pessimism. |

| Import Price | Changes in the price of imported goods and services. This contributed to the inflation rate for businesses and consumers, particularly those who rely fully on imports of goods and services. |

| Industrial Production | Changes in inflation adjusted julah with the results of manufacturing, mining and utilities. This is an indicator of economic health - the production is dominant in the economy and react quickly in the movement up and down in the business cycle. |

| ISM Manufacturing PMI | Level composite index based on surveyed purchasing managers in manufacturing industry. Above 50 indicates expansion, below 50 indicates contraction. This is an indicator that shows economic health, the possibility of purchasing managers is a reflection of the economic relevance of a company. |

| ISM Manufacturing Prices | level composite index based on surveyed purchasing managers in manufacturing industry. Above 50 indicates rising prices, falling prices indicate the contrary. This shows inflation to consumers, while businesses pay more for goods and services, higher prices are also provided to the consumer. |

| ISM Non – Manufacturing PMI | Composite index based on the level of purchasing managers surveyed, except the manufacturing industry. This indicates economic health, business reacts more quickly to market conditions. |

| Ivey PMI | Composite index based on the level of purchasing managers surveyed. In the top 50, will experience expansion, while below 50 will experience a contraction. This is an indication of economic health, the business to react quickly to market conditions, and are a reflection of purchasing managers that are relevant for the company's economic |

| Labor Cost Index | Changes in labor payments, other than overtime hours. This indicates consumer inflation, as businesses pay more to workers, higher prices will apply to the consumer. |

| Leading Index | Changes at the level of a composite index based on 10 economic indicator. 10th indicators are related to employment, production, new orders, consumer confidence, housing, stock market prices, money supply and the interest rate spread. |

| Leading Indicators | Level composite index based on 12 economic indicators. This index is designed to predict the direction of the economy. |

| M2 Money Stock | Changes in the total number of domestic currency in circulation and deposits in banks. This is closely related to interest rates. |

| Manufacturing PMI | Level composite index based on a survey of purchasing managers of manufacturing industries. In the top 50, will experience expansion, while below 50 will experience a contraction. This is an indication of economic health, the business to react quickly to market conditions, and are a reflection of purchasing managers that are relevant for the company's economic |

| Manufacturing Production | Changes in the total inflation adjusted with the results produced manufactures. Manufacturing dominates 80% of total industrial production and tend to dominate the market. This indicates economic health, production reacts quickly to move up and down in the business cycle and is associated with the condition of the consumer. |

| MI Inflation Expectations | The percentage that consumers expect prices of goods and services will change at 12 months into the future. Expectations on future inflation may cause the actual inflation. |

| MI Inflation Gauge | Changes in prices of goods and services purchased by consumers. This data provides a monthly view on consumer inflation. |

| Minimum Bid Rate | limit of the lowest interest rates given the banks. High or low interest rates reflect the attitude and measures taken by the ECB. |

| Monetary Base | Changes in the amount of domestic currency in circulation and deposits at the BOJ. This is related to interest rates, money supply and increasing the use of investment and then lead to inflation. |

| Monetary Policy Meeting Minutes | Reports from council BOJ policy meeting, discussing the economic conditions that affect their decisions in setting interest rates |

| Money Supply | Changes in the total number of domestic currency in circulation and banks. This is related to interest rates - at first in a cycle of increasing the supply of money into the use and investment, then multiply the money supply can lead to inflation. |

| NAHB Housing Market Index | Level composite index based on home builders. Surveys were conducted on 900 construction workers. |

| Nationwide Consumer Confidence | The level of a composite index based on consumers surveyed. This is an indicator for consumer spending. |

| Natural Gas Storage | Changes in the amount of natural gas in the ground. |

| Net Lending to Individuals | Changes in the total value of new consumer credit. This is related to consumer spending and confidence. |

| New Loans | Yuan's value of new loans to consumers and businesses. Borrow and use is positively related to - consumers and businesses tend to look for credit when they are confident will position their financial future and comfortable in using the money. |

| New Motor Vehicle Sales | Changes in the number of new cars and trucks were sold domestically. This is a sign of consumer confidence. |

| NHPI | Changes in selling prices of new homes. This is a health indicator for the housing industry because rising house prices will invite investors and encourage industrial activity. |

| NIESR GDP Estimate | Change the value of goods and services that are expected. NIESR monthly GDP estimate data to predict the government data on quarterly basis. |

| Non - Farm Employment Change | Changes in total employment over the past month. This is an important economic data are released after the end of the month. Job creation is important for consumer spending. |

| Official Bank Rate | The interest rate that banks lend to other banks through the BOE. Short-term interest rate is the highest factor in the evaluation currency. |

| Overnight Call Rate | Where the BOJ interest rate to discount bills and extend the re-lending to financial institutions. Short-term interest rates is a top factor in currency valuation. |

| Parliamentary Election | Voters will choose 650 members of the British Parliament. |

| Pending Home Sales | Changes in the number of homes to be sold but the contract is still awaiting closure of the transaction, unless a new transaction. This indicates economic health. |

| Personal Income | Changes in the total value of receipts received from all sources by consumers. |

| Personal Spending | Changes in the total value of the inflation adjusted consumer spending. This is important data, although it has a mild effect on the retail sale. |

| Philly Fed Manufacturing Index | Level composite index based on the manufacturers surveyed Philadelphia. Above 0.0 indicates an increase. Surveys conducted in 250 districts of the manufacturing Philadelphia Federal Reserve. |

| PPI | Changes in the price of finished goods and services sold to consumers. |

| PPI Input | Perubahan harga barang dan bahan baku yang dibeli oleh manufaktur. Hal ini merupakan indikator adanya inflasi konsumen. |

| PPI Output | Changes in prices of goods and raw materials purchased by manufacturers. This is an indicator of consumer inflation. |

| Prelim Machine Tool Orders | Changes in prices of goods and raw materials sold by manufacturers. Only goods produced domestically. |

| Prelim Nonfarm Productivity | Changes in the total value of new orders by manufacturers of machine tools. |

| Prelim Unit Labor Costs | Annual changes in labor efficiency in producing goods and services, unless the agricultural industry. As businesses increase wages of workers, consumers will be charged a higher |

| Prelim UoM Consumer Sentiment | Level composite index based on the surveyed consumers. Confidence in financial terms is an indicator of consumer spending. |

| Prelim UoM Inflation Expectations | The percentage of consumers expect prices of goods and services will change at 12 months. Expectation on future inflation will lead to actual inflation, since workers tend to try to get higher salaries when they believe that prices will rise |

| Retail Sales | Changes in the total value of inflation at the retail level. |

| Revised Industrial Production | Changes in the amount of inflation, adjusted with the results produced by manufacturing, mining and utilities. This indicates economic health - the production moves up and down rapidly at bisnois cycle and is closely linked to conditions such as consumer-level employment and income. |

| RICS House Price Balance | Pensurvei composite index level at the property. This is an indicator of inflation because pensurvei know the house price data at the time. |

| Rightmove HPI | Changes in housing demand that a sale price. This is an indicator that shows the home health industry because of increasing house prices could invite investors and encourage industrial activity. |

| RPI | Changes in prices of goods and services purchased by consumers for consumption. Different from the CPI, RPI, RPI only measures goods and services consumed by households and only includes the price of houses that are not included in the CPI. |

| SECO Consumer Climate | Level composite index based on the surveyed households. Above 0.0 indicate optimism, below that indicates pessimism. 1100 household survey to fill out the level of economic conditions. |

| Sentix Investor Confidence | Level composite index based on the investors and analysts surveyed. Above 0.0 indicate optimism on the contrary indicates pessimism. This shows the health of the economy - investors and analysts informed of their work moral, and change their sentiments may be early signals for future economic activity. |

| Services PMI | Level composite index based on surveyed purchasing managers in service industries. This is an indication of economic health, the business to react quickly to market conditions, and are a reflection of purchasing managers that are relevant for the company's economic |

| SVME PMI | level composite index based on the purchasing managers surveyed. Above 50 indicates expansion of the industry, on the contrary indicates contraction. This is an indicator of economic health, in which businesses react quickly terhadapa market conditions. |

| Tertiary Industry Activity | Changes in the total value of services purchased by businesses. This shows ekonomoi health, business quickly influenced by market conditions, and changes in total expenditure can be early signals of future economic activity. |

| TIC Long-Term Purchase | The difference between the value of foreign securities that are bought by residents of long term U.S. and by foreign parties in a particular period. Demand on the domestic securities and currencies are interconnected because the foreigners have to buy the domestic currency to buy securities of a country. |

| Total Vehicle Sales | The number of cars and trucks sold annually, domestically over the past month. This data is reported with monthly data but annual format. This is a sign of consumer confidence, increasing demand for expensive goods that consumers have confidence in its financial position and feel comfortable in spending money. |

| Trade Balance | The difference between exports and imports. Positive figures indicate exports more goods than imports. Export affect the amount of production and prices. |

| Unemployment Claims | The number of individuals who fall into unemployment insurance. Total unemployment is an important signal for economic health. |

| Unemployment Rate | Percentage rate of unemployment. Total unemployment rate is an important signal of overall economic health. |

| Visitor Arrivals | Changes in the number of foreign visitors who come into the country in the short term. Important for the economic impact of tourism - about 10% of the population employed in the tourism industry sector. |

| Wage Price Index | Changes in business and government payments to the price of labor except a bonus. It showed consumer inflation. |

| Wholesale Inventories | Changes in the total value that existed at the wholesale inventory. This is a signal of future expenditures for companies to buy goods when they have insufficient inventory |

| ZEW Economic Expectations | Level composite index based on institutional investors and analysts. Above 0.0 indicate optimism on the contrary indicates pessimism. |

EURUSD : Bullish entry 1.22581 tp1 1.23585 tp2 1.24857 sl 1.21758

GBUSD : Bullish entry 1.43593 tp1 1.44427 tp2 1.46028 sl 1.42497

USDCHF : Bearish entry 1.14572 tp1 1.13916 tp2 1.12712 sl 1.15332

USDJPY : Bullish entry 91.784 tp1 92.438 tp2 93.076 sl 91.320

This section will explain about the commodity and how their relationship with the commodity currencies.

What is a commodity currency?

In the world of Forex, there are currency, known as commodity currencies, the currencies of countries that are eksportis raw materials or commodities (such as precious metals, oil, agriculture, etc.). Many countries that fit the description above but the most traded are the New Zealand Dollar, Australian Dollar and Canadian Dollar. Therefore, known by the name of the commodity dollars or "Comdolls".

How commodities affect commodity currency?

In the financial world, gold is seen as a safe haven against inflation and also the most heavily traded commodity. For some people, such as trading the Australian dollar gold trading. Australia is the world's largest gold producer and 50% of exports are commodities, including precious metals.

This commodity represents a large portion of Australia's GDP; many traders see the rise and decline of commodity prices, especially gold, which can affect the Australian dollar. Some traders consider the movement of gold as a measure to predict the movements of the AUD / USD.

Read More....

For countries producing large quantities of raw materials, the increase of commodity prices allows the country's currency price also rises and vice versa. Below is a commodity currency and how its movement is correlated with a particular commodity.

Canadian Dollar (CAD) and Oil ?

Oil is the lifeblood of the industrialized world and therefore in these conditions, the oil is a commodity traded and observable. Many countries that produce oil in excessive amounts, including Canada, which is one of the world's largest oil producer and has the second largest oil reserves after Saudi Arabia. Canada is also the largest supplier to the biggest oil consumer the United States. Because oil is one of the greatest needs in the industrial United States, raising the price of oil tends to give a bad influence on the U.S. equities and U.S. dollar, in turn will increase the income for Canada.

Oil is the lifeblood of the industrialized world and therefore in these conditions, the oil is a commodity traded and observable. Many countries that produce oil in excessive amounts, including Canada, which is one of the world's largest oil producer and has the second largest oil reserves after Saudi Arabia. Canada is also the largest supplier to the biggest oil consumer the United States. Because oil is one of the greatest needs in the industrial United States, raising the price of oil tends to give a bad influence on the U.S. equities and U.S. dollar, in turn will increase the income for Canada.

INCREASE oil prices tend to benefit Canada or harm the United States.

DECREASE in oil prices tend to be detrimental to Canada or the United States profitable.

If the trend of rising oil, the USD / CAD tends to have a trending down, and vice versa.

In the financial world, gold is seen as a safe haven against inflation and also the most heavily traded commodity. For some people, such as trading the Australian dollar gold trading. Australia is the world's largest gold producer and 50% of exports are commodities, including precious metals.

This commodity represents a large portion of Australia's GDP; many traders see the rise and decline of commodity prices, especially gold, which can affect the Australian dollar. Some traders consider the movement of gold as a measure to predict the movements of the AUD / USD.

INCREASE the price of gold tends to benefit Australia.DECREASE gold prices tend to be detrimental to Australia.

Like neighboring Australia, New Zealand's economy is also driven by commodity exports. Most traders do not compare the "Kiwi" with a particular commodity, but the state of commodities markets globally. So rise and fall of commodity prices as a whole, can give NZD movement / USD due to the dependency of New Zealand on their commodity exports.

Summary

Short term movements in commodity prices usually do not directly affect the currency. Analyzing the relationship with the commodity currencies is better suited for long-term outlook (long term). Although we saw no correlation between the commodity currencies and commodity prices alone, the export is only one part of the economy of a country. We must always look at the country's overall economy, interest rates and political situation. Combining all these aspects will produce a clearer picture and add a better idea of trading on the currency.

Summary

Short term movements in commodity prices usually do not directly affect the currency. Analyzing the relationship with the commodity currencies is better suited for long-term outlook (long term). Although we saw no correlation between the commodity currencies and commodity prices alone, the export is only one part of the economy of a country. We must always look at the country's overall economy, interest rates and political situation. Combining all these aspects will produce a clearer picture and add a better idea of trading on the currency.

Commitment necessary to organize action in trading through preparation. So that you can always reactive face of the strengthening and weakening of the dynamics of the futures market.

Here are some aspects of discipline that should be explored in an effort to develop the character yourself. These values are valuable stock to plunge directly into the futures market, both in product Forex, Index and Commodity.

1. Study

Yes, learn and keep learning! This is the keyword for all the futures market investors. Most of beginner forex traders are reluctant to take the time to study the factors driving the currency. At the very least, a trader must have a willingness to learn fundamental analysis.

2. Avoid Overtrading

Transactions that are too aggressively, performed many times with a distance of Stop-Loss and Take-Profit targets that are too short would benefit only the broker alone. Apart from gains or losses that you received, the broker will still get a commission.

Take-Profit Set targets only a few dollars a day just to lock the profit in small quantities. Do not be forced to take a Take-Profit larger, it was a strategy leads to more harm and gambling.

3. Avoid Over Leveraged

Leverage can be likened to a double-edged sword. Certain broker can force you to use the High Leverage. It must be remembered that not all brokerage recommendations deserve to be obeyed.

Meaning: with high leverage, real estate income derived from the greater spread. Position-size will determine the amount of total income from the spread. So, the bigger positions with High Leveraged, the greater the spread income earned by the broker.

4. Not Rely On Other People

Trader true is a figure who could succeed because of business and its own merits. Every decision does not depend on others. Learn or ask for help to the trader's trading with more experience was good, but it would be wise if all decisions are still born out of ourselves.

5. Couples Watch Currency, Not One Currency

To be able to accurately predict the direction, you should not just look from one currency only. Same way with only half the transaction estimate the movement. To be effective, do also predict the future direction of the currency pair (pair). Because of the success of this transaction depends entirely on the second currency.

6. Preparation Before Trading

Put the horses in the form of trade policy and specific rules, such as: You are ready loss / profit on how many points? Amounted to 30, 50 or 70 points per enter the market? Or 30, 50 or 70 percent of the initial capital? Determine your attitude here! If you do not have specific policies and rules, then you really do not have the preparation in the trades.

We recommend that you do not tend to classify themselves on the statistical 95 percent loss-Trader, which in turn forces you to stop trading. So that left the arena with the blame instruments and market his business.

7. Trend Following

There are substantial differences between; 'buying at a low price', when the graph is the price continues to decline with a 'buy on the cheap'. Low prices will soon become a high price, when you make trades against the trend.

8. Poor Liquidation Transactions

When you're in the position of the transaction and the results are not good, you have to do is; 'pleasing' (liquidation) position with the appropriate levels. Do not drag on so risky position to add the damage.

Conversely if you have a good transaction and profit (a little), do not be too hasty to immediately liquidate positions or simply out of boredom waiting to get out of stress. It takes a little patience to arrive at a convincing profit. Get familiar with the stress, because stress is a natural process that must be passed by a trader.

Conversely if you have a good transaction and profit (a little), do not be too hasty to immediately liquidate positions or simply out of boredom waiting to get out of stress. It takes a little patience to arrive at a convincing profit. Get familiar with the stress, because stress is a natural process that must be passed by a trader.9. Notice of Technical Condition

Determining whether the market trend has ended or find pri

in reference to: orkut - my profile (view on Google Sidewiki)

The Federal Reserve said that although financial conditions in the United States has grown since the crisis of 2008, events in Europe still show a vulnerable condition. Donald Kohn said in a speech in Canada that financial markets are still vulnerable due to the debt crisis of Europe. Therefore, in these conditions, the Fed take joint action with other central banks on Sunday to exchange currency. Banks that engage in "exchange" The dollar is the Bank of Canada, Bank of England, European Central Bank, Swiss National Bank and Bank of Japan. European banks need dollars to be loaned to companies in other continents. European companies hire employees, purchase of raw materials, oil and commodities by using the dollar.

Fed to lend 9.2 billion dollars to the European Central Bank to conduct such exchanges. European debt crisis first appeared in Greece later emerged fear will spread to Spain, Portugal and the euro zone countries other. This crisis has stimulated demand for U.S. dollar and weaken the value of the Euro. Narayana Kocherlakota, frontman of the Federal Reserve Bank of Minneapolis says that the decision also was required to maintain a stable dollar. They do not do this because there is a special relationship with Europe - they are American policymakers, it is intended to strengthen the American economy, he adds in a speech to business people in Wisconsin.

Read More....

Eight banks face U.S. government investigations, including the problem of rating mortgage products (mortgage) to them. Andrew Cuomo, an attorney in New York are investigating whether there is a possibility mjanipulasi between banks and credit rating agencies to get a better rating securities. Banks are investigated include Goldman Sachs and Morgan Stanley. One cause of the crisis is due to bad U.S. mortgages.

The lawyer has requested information from the eight banks, as well as the three major rating agencies - Standard & Poor's, Moody's and Fitch Ratings. Other institutions that were investigated by Cuomo is UBS, Citigroup, Credit Suisse, Deutsche Bank, Credit Agricole dams Merrill Lynch - now part of Bank of America. Investigations conducted after the Senate decided to tighten credit rules, which allegedly is one of the main causes of one of the financial crisis that occurred. Senators argued that these agencies have allowed the bank - a bank to sell high-risk financial products to low rating.

Read More....

American session

19:20 pm - Europe - Axel Speech Weber - President of the Deutsche Bundesbank will bring a seminar entitled "Lessons for monetary policy from financial crisis" at the 12th annual Seminar on Inflation Targeting Banco Central do Brazil, Rio de Janeiro.

19:30 pm - Canada - Manufacturing Sales - After a relatively stagnant last month, the volume of sales by manufacturers in Canada are expected to again increase at 1.1% today. If released better than these figures, it will be advantageous CAD.

19:30 pm - U.S. - Retail Sales and Core Retail Sales - Having posted a significant increase last month, retail sales data today is predicted to slow down, but still in positive zone.

20:55 pm - America - Preliminary UoM Consumer Sentiment - consumer sentiment in the last three months continues to decline, and last month a significant decrease. Data today will probably show an increase to 73.5, if released in the above predictions will benefit the USD, contrary to a further decline will put pressure for the currency.

21:00 pm - America - Business Inventories - This number shows the amount of inventory tied up in the manufacturing warehouse, the smaller the numbers are released the better for CAD because it depicts the high consumer demand.

Portugal plans to order a high salary rules and also cut the state budget to reduce a deficit that continues to swell. Pruning is a government effort to combat the national debt that continues to be a burden. German Chancellor Angela Merkel, warned that the EU will increasingly depressed and threatened if the euro slumped due to ongoing debt crisis.

Euro currency continued to fall until it reaches its lowest point during the last 14 months is 1.2517 to the dollar on Thursday. Global markets seem panicked to the uncertainty in Europe. In addition, investors also feared that with an explosion that occurred in Greek prisons and also an indication kriminalisai by nine banks.

Apart from Greece who has now lowered its credit rating, international attention is now focused on Portugal and Spain, which has also lowered its lending rate. Both countries are feared to have a fate similar to Greece. Portugal Prime Minister Jose Socrates announced it would cut salaries of civil servants and ministers. In addition, he also raised taxes about 1% to 21% currently. As one member European Zone, Portugal should keep the rate below 3 per cent deficit. Meanwhile, from Spain, the government is cutting salaries by 5% and are saving up to 50 billion euro budget.

Subscribe to:

Posts (Atom)